As always, you can click to enlarge.

Now I'll be the first to admit that in the past government propaganda like this went straight into the shredder. In order to gauge the disconnect between what Uncle Sam does and what Uncle Sam says, though, I elected to read this one and expose myself to the ire of irony, the disappointment of half-truths from a faceless master.

A Ponzi scheme is a fraudulent investment operation that pays returns to separate investors, not from any actual profit earned by the organization, but from their own money or money paid by subsequent investors. The perpetuation of the returns that a Ponzi scheme advertises and pays requires an ever-increasing flow of money from investors to keep the scheme going. The system is destined to collapse because the earnings, if any, are less than the payments to investors. Thanks Wikipedia.

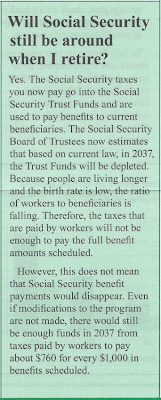

Often we hear the term Ponzi bandied about by "shocking" personalities who try to view the future landscape rather than dive whole-hog into the delightful idiocy of the status quo. Well, the Social Security Administration lays out pretty clearly how things work in their shop, "The Social Security taxes you now pay go into the Social Security Trust Funds are are used to pay benefits to current beneficiaries." Not too much room for interpretation in that. Would fraudulent be the only distinction between the Social Security Trust and Bernie Madoff? Princeton's wordnetweb defines fraud as intentional deception resulting in injury to another person. In avoiding outright fraud, Sam presents the not so subtle indication that starting in 2037, barring any future raises in eligible retirement age, taxation rates, etc., you can go ahead and start to expect receiving not your full contribution, but $760 out of every $1000 in expected entitlement. Awesome, you get negative ROI, without a choice as to whether you care to participate in the first place.

Thankfully, with the balance of your thinning after tax margins, you get some counseling on savings courtesy of a government that's tinkering with the deficit ceiling.

Without so much as telling the poor bastards that read this pap to get into the stock market, Uncle Sam omits telling the whole truth, perjury by any other name. By putting $25 to $50 bucks into your mortgage you save future expense, and guarantee your return. So which is more likely: Joe "Swipe Swipe" Sixpack who reads and believes this crap sits on 50 grand after 20 years in the market garnering that 5% or Joe has a little more confidence in himself in that toasty, dry house? Unfortunately, the game is rigged against those without fiscally prudent parents because no one gets a solid, fundamental financial education in public schools. No, that time is already earmarked for hard-hitting topics like Dante's Inferno, and the uses of Geometric proofs on millenia old mathematical laws.

Other ideas for consideration:

- What does the decline of religious belief in this Country have to do with the declining value of the dollar, especially with reference to "in God we trust?"

- What do TBTF mortgage servicers do? What does FNM do? Why is Chase direct drafting me for a note that the government owns?

- Why is the government going batshit with the credit card while encouraging the unwitting masses to save?

- Should it be illegal for the government to offer a service while creating the expectation that that service will not be delivered in full?