I think the decline of JCP is over-exaggerated, that clearance inventory blowouts could symbolize a "kitchen sink" quarter, and that JCP can finalize its transition by making a few small, corrective changes.

Walking into a store's bright white interior with Sephora prominently featured out front sets a tone that isn't followed through the rest of the plan. Particularly representative of this failed continuity is housewares. Who in the world buys housewares from JCPenney?! Upmarket housewares to a retailer must be like the furniture business to landlords. It's as though some people are genetically wired to go into the business of beating their fucking brains out, with virtually no chance to survive because margins can't meet consumer turnover in down times.

The JCP architectural concept is confused by the offerings proffered within. Carry the feel of the front through to the back of the store. Replace housewares with a lingere shop that feels a little secluded, like the back corner of the video rental store used to be.

Picking merchandise buyers to compete with the Gap, with Victoria's Secret, with Express and Penguin and other retailers will bring the store-within-a store concept to a demographic that is most likely to spend on it. The only difference between Sri Lankan sweatshop apparel from Express and JCP is that Express doesn't make as many mistakes with respect to color, cut, and style. Fix your buyers and you fix the store.

Eero Saarinen famously waited until his buildings saw snow in order that sidewalks be placed where people naturally walk. Ron Johnson should know from his experience at AAPL that Steve Jobs's genius manifests itself in beautiful, instinctive products.

The difficulty in retailing isn't figuring out how to make a dollar selling clothes, and it isn't as simple as offering what most people want most of the time. Retailing is about offering what most spenders want most of the time. Wage deflation due to inflation in the cost of economic inputs (gas and food) is real and it isn't going away. If you're - rightly - going to fight the competition with price, make sure that you are taking share. To do so you must compete directly: color, cut, style.

In closing, carry the initial feel of the stores from the front door to the back corner, and enhance product offerings by choosing better buyers, or go vertical and make your own stuff if the market can't tailor to your needs.

ps - The men's merchandise is very close. Do away with the contrivances like jackets with pockets on the sleeves, and dump the shapeless sacks of shirts in favor of something that a normal, respectable dude could wear to the office and you're there. The PGA labeled gear is a great deal, if you can find the few gems that aren't composed of terrible color combinations.

You're on the door step, baby. Punch through.

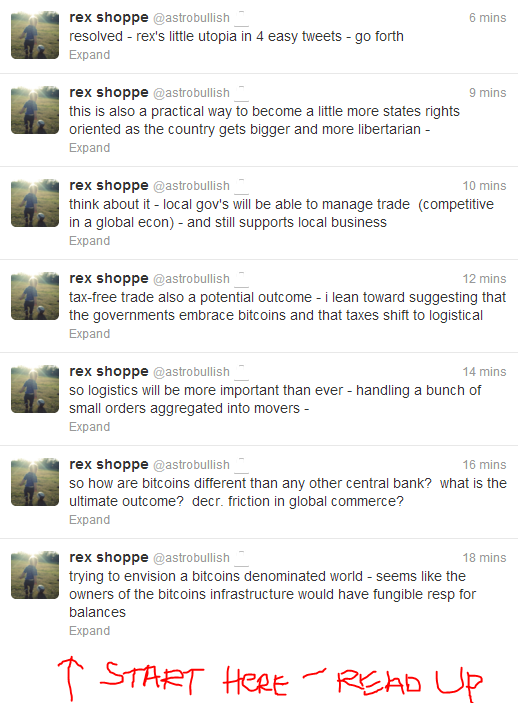

pps - Just saw

this at BusinessInsider. Kitchen sink quarter - think about it.